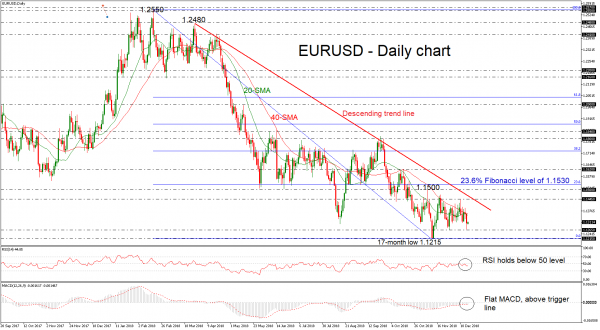

EURUSD finished the previous week in negative territory as it touched once again the 1.1265 support level, remaining below the 20- and 40-simple moving averages (SMAs) in the daily timeframe. The pair continues the negative tendency over the last eight months, increasing distance below its negatively sloped trend line.

Meanwhile, the technical indicators continue to slow down, mirroring the market’s bearish behavior over the past week. The RSI indicator is still moving in the bearish zone, flagging that a downside move could reemerge in the short term. The MACD is flattening above its red signal line but is still moving below the zero line in the near term.

Should the pair experience more negative pressure and drops below the 1.1265 area, the market could meet support at the 17-month low of 1.1215, before the price heads sharply lower towards the 1.1115 mark, identified by the lows on June 2017. In case of steeper declines, the pair could breach this trough, diving to 1.0830, which was reached in May 2017.

On the other side, in case of a climb above the moving averages, the price could challenge the 1.1445 region. More advances could send prices towards the 1.1500 strong psychological level, registered on November 7, which stands near the descending trend line. Slightly above this region, the 23.6% Fibonacci retracement level of the downleg from 1.2550 to 1.1215, around 1.1530 could be next level to focus on.

Concluding, the bearish picture in the long-term looks to persist for a while longer as EURUSD has been developing in a downtrend since March of the current year.