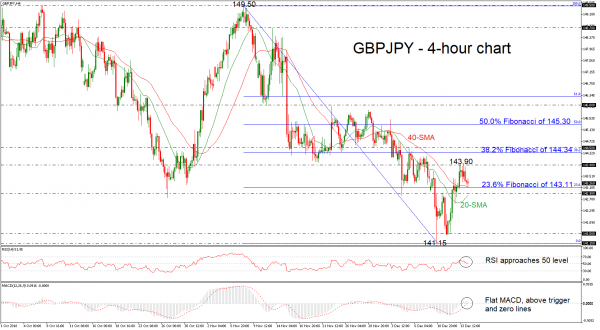

GBPJPY has declined considerably after touching several times the 143.90 resistance level in the previous daily session. In the short-term the bias seems to be negative, while on the daily chart the pair remains in a sideways channel over the last four months with upper boundary the 149.50 resistance and lower boundary the 141.15 support.

Technically, on the 4-hour chart, the RSI indicator is pointing south near the 50 level, while the MACD oscillator is moving above the trigger line with weak momentum.

Immediate support is coming from the 23.6% Fibonacci retracement level of the downleg from 149.50 to 141.15, near the 40-simple moving average (SMA), at 143.11. Slightly below this barrier, the market could rest on the 142.90 support, taken from the inside swing on December 12. A downside extension could hit the 141.50 barrier, taken from the latest lows.

If there is a successful attempt higher and a jump above 143.90, GBPJPY could hit the 38.2% Fibonacci region of 144.34, before touching the 144.50 resistance. A successful jump above these lines could push the market until the 50.0% Fibonacci of 145.30.

Overall, the neutral picture in the medium term looks set to last for a while longer after prices failed to create a rally to exit from the range. In the short-term, the pair has been trading in a descending movement following the touch of 149.50.