Gold price faced a solid resistance near $1,250 and recently declined. Crude oil price is placed nicely above the $52.00 support area and it could move higher in the short term.

Important Takeaways for Gold and Oil

- Gold price topped near the $1,250 level recently and started a downside correction against the US Dollar.

- There is a major bearish trend line formed with resistance at $1,245 on the hourly chart of gold.

- Crude oil price settled above the key $52 support area with positive signs.

- There is a major bearish trend line formed with resistance at $53.80 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

Gold price gained bullish momentum this past week and traded above the $1,235 and $1,240 resistance levels against the US Dollar. The price even broke the $1,248 resistance and tested the $1,250 barrier.

Sellers appeared near the $1,250 level and protected further gains. A high was formed close to the $1,251 level and later the price started a downside move. The price declined below the $1,246 level and settled below the 50 hourly simple moving average.

A low was formed near $1,240 on FXOpen before the price started an upside correction. It moved above the 23.6% Fib retracement level of the last decline from the $1,246 low to $1,240 high.

However, the upside move was capped by the $1,244 level and the 50 SMA. Moreover, the 50% Fib retracement level of the last decline from the $1,246 low to $1,240 high also acted as a resistance.

More importantly, there is a major bearish trend line formed with resistance at $1,245 on the hourly chart of gold. Therefore, if the price corrects higher, it is likely to face a lot of sellers near the $1,244 and $1,245 resistance levels.

On the downside, the $1,240 level is an initial support, below which the price may perhaps test the $1,236 support area in the near term.

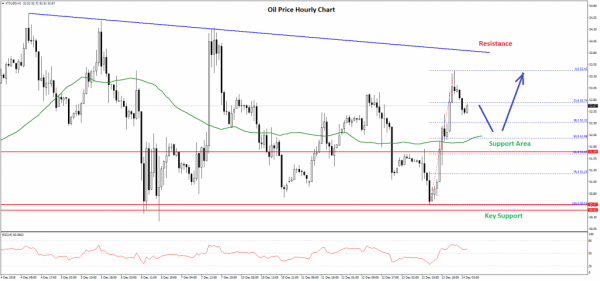

Oil Price Technical Analysis

Crude oil price formed a solid support base near the $50.50 level and later started an upward move against the US Dollar. The price traded higher and broke the $51.00 and $51.50 resistance levels.

The upside move was positive as there was a close above the $52.00 resistance and the 50 hourly simple moving average. It opened the doors for more gains and the price recently traded towards the $53.50 level and formed a high at $53.42.

Later, there was a downside correction and the price moved below the 23.6% Fib retracement level of the recent wave from the $50.55 low to $53.42 high. However, there is a strong support formed near the $52.00 level and the 50 hourly SMA.

Moreover, the 50% Fib retracement level of the recent wave from the $50.55 low to $53.42 high is also near $52.00 to act as a support. Therefore, if the price corrects lower from the current levels, buyers are likely to protect losses below the $52.00 support.

On the upside, the $53.50 level is an initial resistance. The main resistance is near $54.00 and a major bearish trend line formed with resistance at $53.80 on the hourly chart of XTI/USD. Therefore, it won’t be easy for buyers to clear the $54.00 resistance in the near term.