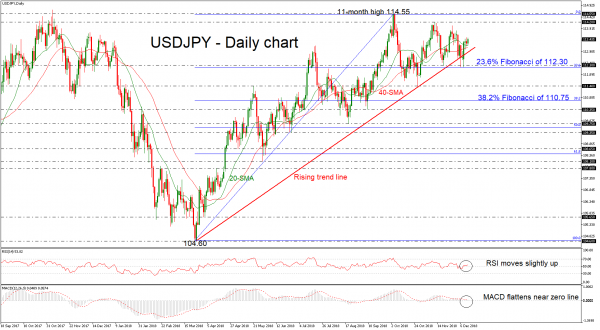

USDJPY has been facing buying interest after the rebound on the 23.6% Fibonacci retracement level of the upleg from 104.60 to 114.55, around the 112.30 support. The pair remains above the long-term ascending trend line, however, the technical indicators are moving with weak momentum. The RSI is pointing marginally up in the bullish zone, while the MACD oscillator is flattening near the trigger and zero lines in the short-term.

As the price advances above the 20- and 40-simple moving averages (SMAs), the expectation is an extension of the upward tendency towards the 114.20 resistance, registered on November 12. If this is also broken, resistance could come from the eleven-month high of 114.55, while even higher the 115.50 high, reached on March 2017 could be the next level for investors to look for.

On the other side, should negative momentum come into play and the price slides below the rising trend line as well as below the 23.6% Fibonacci, the bears could retest the 111.40 support level, taken from the low on October 26. Moving lower, the 38.2% Fibonacci of 110.75 could be a stop for the bears before slipping until the 110.35 area.

To sum up, in the longer-term view, USDJPY retains a bullish outlook over the last nine months. A daily close below the ascending trend line could signal a shift of the outlook to a more neutral one in the near term.