Key Highlights

- The Euro rallied recently and traded above the 0.8900 and 0.9000 resistances against the British Pound.

- There is a crucial bullish trend line formed with support at 0.8960 on the 4-hours chart of EUR/GBP.

- The US CPI in Nov 2018 increased 2.2% (YoY), similar to the forecast, but less than the last 2.5%.

- Today, the ECB Interest Rate Decision is lined up and the central back is expected to make no change in rates.

EURGBP Technical Analysis

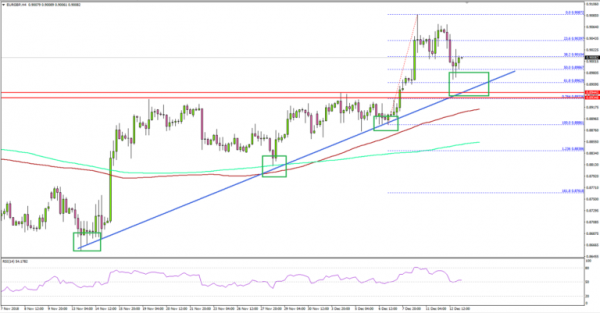

The Euro gained pace in the past few days and rallied after forming support near 0.8880 against the British Pound. The EUR/GBP pair traded above the 0.8900 and 0.9000 resistance levels.

Looking at the 4-hours chart, the pair even traded above the 0.9050 level and it is currently trading well above the 100 simple moving average (red, 4-hours). A new monthly high was formed at 0.9087 before the pair started a downside correction.

It corrected below the 23.6% Fib retracement level of the recent wave from the 0.8886 low to 0.9087 high. However, there are many important supports on the downside near the 0.8980 and 0.8940 levels.

There is also a crucial bullish trend line formed with support at 0.8960. An intermediate support is near the 50% Fib retracement level of the recent wave from the 0.8886 low to 0.9087 high.

Therefore, if the pair corrects lower from the current levels, it is likely to find support near the 0.8980 or 0.8940 level. On the upside, an initial resistance is at 0.9060, above which the pair may climb above 0.9100.

Fundamentally, the US Consumer Price Index for Nov 2018 was released by the US Bureau of Labor Statistics. The market was looking for a 2.2% rise in Nov 2018 compared with the same month a year ago.

The result was similar, but it was less than the last 2.5% increase. The monthly change was flat, whereas there was a 0.3% rise in the previous month. The report added that:

The gasoline index declined 4.2 percent in November, offsetting increases in an array of indexes including shelter and used cars and trucks. Other major energy component indexes were mixed, with the index for fuel oil falling but the indexes for electricity and natural gas rising. The food index rose in November, with the indexes for food at home and food away from home both increasing.

Pairs like EUR/USD and GBP/USD recovered after the release, but both are still trading below key resistance levels.

Economic Releases to Watch Today

- German Consumer Price Index for Nov 2018 (YoY) – Forecast +2.3%, versus +2.3% previous.

- German Consumer Price Index for Nov 2018 (MoM) – Forecast +0.1%, versus +0.1% previous.

- ECB Interest Rate Decision – Forecast 0%, versus 0% previous.

- US Initial Jobless Claims – Forecast 225K, versus 231K previous.