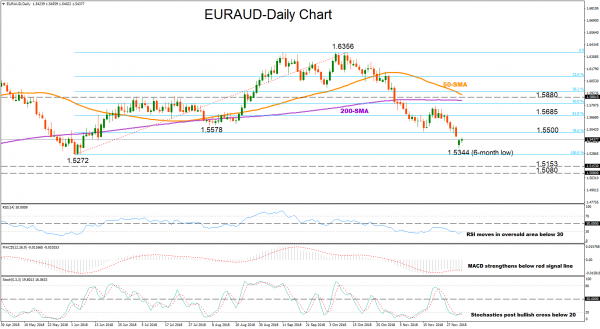

EURAUD opened with a gap down on Monday, extending the steep downfall off 1.6356 to a six-month low of 1.5344. The move painted a more bearish picture for the market, with the MACD suggesting that some weakness is still in storage as the indicator has reversed back below its red signal line. Yet the RSI and the Stochastics signal that the market is oversold, and upside corrections might emerge in the very short term.

On the upside, the pair is expected to find immediate resistance around the 78.6% Fibonacci of the upleg from 1.5272 to 1.6356, near 1.5500 – the area that has restricted both upward and downward movements in the past. Moving higher, bulls might find resistance around 1.5578, taken from the lows on August 7, before continuing up the path to the 61.8% Fibonacci of 1.5685. Traders, however, would be eagerly looking for a close above 1.5880 to confirm that gains are sustainable.

If it falls lower, the pair could retest yesterday’s trough of 1.5344 ahead of the 1.5272 bottom formed in June. Should the pair breach the latter, bearish action may pick up steam towards 1.5153, the low on January 11, while further declines may bring the previous 1.5080 support into view.

In the bigger picture, the pair is in neutral mode, trading within the 1.5272-1.6356 range. However, downside risks seem to be rising as the 50-day simple moving average has already changed direction to the downside to meet the 200-day MA.

Summarizing, EURAUD is bearish and oversold in short term, while in the medium term the pair is neutral.