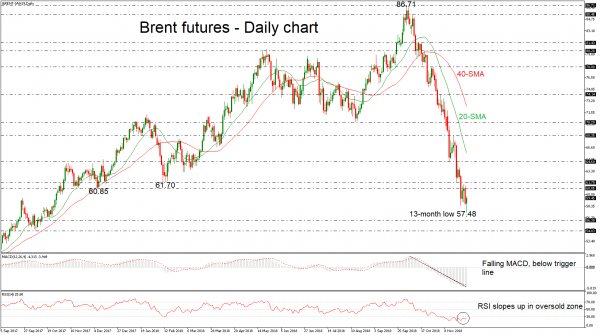

Brent crude oil futures with delivery in January 2019 tumbled to a new 13-month low of 57.48 earlier today, but quickly pared the losses. The price is set to complete the seventh straight negative week, while the technical indicators continue to hold in bearish zones. The MACD oscillator is strengthening its negative bias, while the RSI is pointing marginally up in the oversold region.

In case of a slide below the multi-month low, the next support would come from the 56.30 level, taken from the low in October 2017. Should prices decline further, the focus shifts to 54.83, where it bottomed in October 2017 as well, increasing chances for a new strong bearish tendency.

On the opposite, if the price continues the weak upside movement, it would challenge again the 60.35 – 61.70 resistance zone, before being able to re-touch the 64.60 barrier. A significant leg above these levels could push prices towards the 20-day simple moving average (SMA), which stands around 65.85.

Overall, Brent seems to be strongly bearish over the last almost two months following the pullback on the 86.71 high.