‘GBPUSD is sending mixed signals. The pair briefly dipped under its 50-day average near $1.2410 testing $1.2390 before bouncing back toward $1.2430. While this looks like a successful retest, RSI breaking under 50 suggests momentum turning downward.’ – CMC Markets (based on PoundSterlingLive)

Pair’s Outlook

The Cable edged lower on Friday, with the psychological support around 1.2460/40 failing to limit the losses, but the demand cluster circa 1.2420 succeeding. However, the GBP/USD pair opened with a small bearish gap today, causing the mentioned demand area to be pierced. This does not imply the Sterling is doomed to keep falling; the price is still expected to recover, with the nearest meaningful resistance being at 1.2449, represented by the weekly PP. Nevertheless, the weekly PP is unlikely to hold the Pound for long, even though technical studies are unable to confirm a recovery is due.

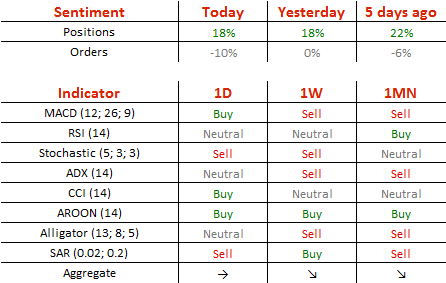

Traders’ Sentiment

There a 59% of traders with a positive outlook towards the Sterling today, unchanged since Friday. At the same time, the portion of sell orders inched up from 50 to 55%.