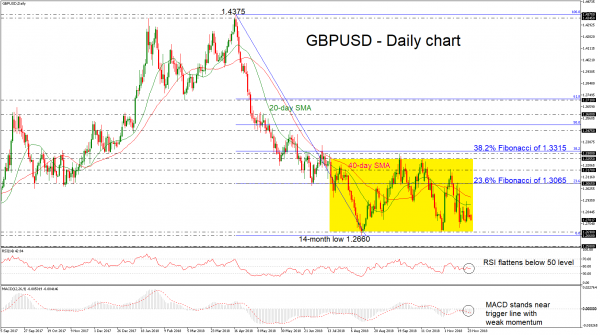

GBPUSD retains sideways movement in the near term, finding strong resistance at the 1.3255 barrier and support at the 1.2690 level. Also, over the last couple of weeks, the price dived below the 20- and 40-simple moving averages (SMAs) but has failed to post a significant bearish rally.

Momentum indicators, signal that the market holds in a consolidation mode as the RSI indicator is flattening below its threshold of 50, while the MACD oscillator stands near the trigger line and below the zero line with weak movement.

In case of a sharp negative run, investors would turn their attention towards the 14-month low of 1.2660 and the 1.2690 support. Further declines may open the way towards 1.2580 where the price registered significant rebound on June 2017, confirming once again the long-term bearish structure.

On the other side, cable could find immediate resistance at the 20-day SMA, which hovers near the 1.2900 handle, while even higher, the 40-day SMA around 1.2960 could act as major resistance as well. Slightly higher, the 23.6% Fibonacci at 1.3065 could be the next level to look for, while if this fails to hold, bullish actions may then try to overcome the previous peak and touch the 1.3170 resistance.

Overall, any penetration of the trading range would adjust the market sentiment accordingly. A close above 1.3255 would bring a more bullish view back into play, however a daily closing candle below 1.2690 would resume the bearish phase.