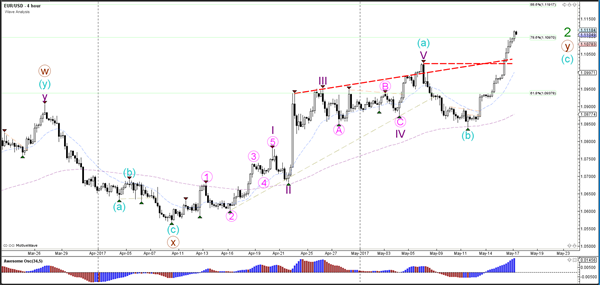

Currency pair EUR/USD

The EUR/USD broke yesterday’s Fibonacci resistance levels and resistance trend lines (dotted red) which was an invalidation level for the bears and a confirmation level for the bulls. The wave count is now reflecting the bullish structure with an ABC (blue). Price is already attempting to break a bigger Fib (78.6%), which could indicate a continuation potential to the 88.6% at 1.1190.

The EUR/USD broke above the resistance trend lines (dotted orange) and extended the bullish momentum. The strength of the impulse is indicating that the current push up is most likely a wave 3 (purple) which might be even completed yet. Price could move towards the Fibonacci targets first of wave 5 (pink) but eventually a wave 4 and 5 (purple) seem likely.

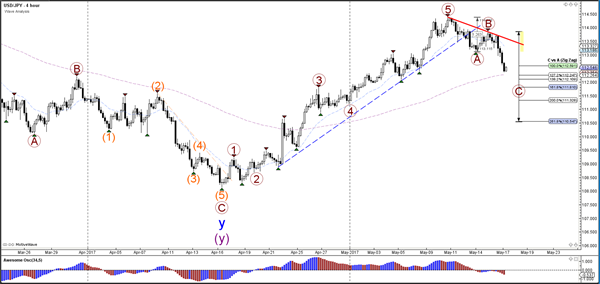

Currency pair USD/JPY

The USD/JPY indeed is completing an ABC (brown) zigzag correction as expected at the beginning of this week. Price is moving towards the Fibonacci targets of wave C (brown).

The USD/JPY is building a wave 3 (orange), which could potentially still see further bearish extensions towards the Fibonacci targets of wave 3 (orange). A wave 4 (orange) correction is expected when the wave 3 is completed.

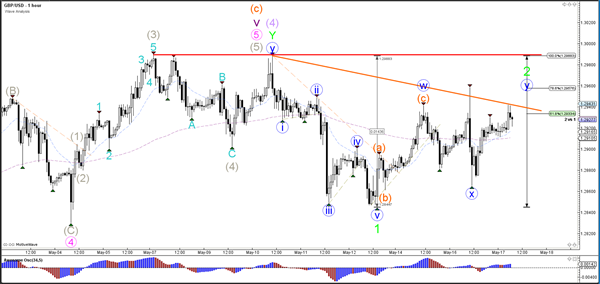

Currency pair GBP/USD

The GBP/USD stopped at the 78.6% Fibonacci level of wave 2 (green). A break below the support trend line (green) could start a larger bearish correction whereas a break above resistance (orange) could see price make a bullish break. The bullish break however would probably create double divergence.

The GBP/USD break above the 100% Fib invalidates the wave 2 (green) structure and confirms a bullish continuation potential for one more push higher.