Key Highlights

- The British Pound found support near the 1.2770 level and recovered against the US Dollar.

- There is a major bearish trend line in place with resistance at 1.2920 on the 4-hours chart of GBP/USD.

- The NAHB Housing Market Index in Nov 2018 declined from 68 to 60.

- Today in the UK, the CBI Industrial Trends Survey Orders report for Nov 2018 will be released, which is forecasted to decline to -7.

GBPUSD Technical Analysis

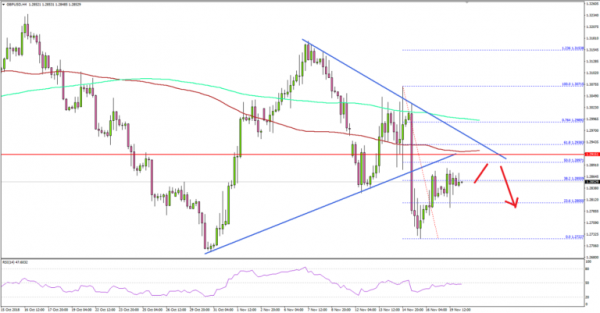

The British Pound fell this past week and traded below the 1.2850 support area against the US Dollar. The GBP/USD pair even traded below the 1.2800 level before buyers appeared near 1.2770.

Looking at the 4-hours chart, the pair formed a low near 1.2770 and later started a decent recovery. It moved above the 1.2820 level and the 23.6% Fib retracement level of the last decline from the 1.3070 swing high to 1.2770 swing low.

However, there is a strong resistance formed on the upside near the 1.2920-1.2930 zone. More importantly, there is a major bearish trend line in place with resistance at 1.2920 on the same chart.

The trend line coincides with the 100 simple moving average (red, 4-hours) plus the 50% Fib retracement level of the last decline from the 1.3070 swing high to 1.2770 swing low.

Therefore, it won’t be easy for buyers to clear the 1.2900, 1.2920 and 1.2930 resistance levels in the near term. If there is an upside break above 1.2930, the pair could recover above 1.3000 in the coming days.

Alternatively, if the pair fails to clear the 1.2920 resistance, the pair could decline back towards the 1.2800 level. The next key support is at 1.2770 followed by the 1.2750 level.

On the flip side, there were decent gains noted in EUR/USD above the 1.1380 level. The pair even managed to move above the 1.1400 level to enter a short term bullish zone.

Economic Releases to Watch Today

- German Producer Price Index for Oct 2018 (MoM) – Forecast +0.3%, versus +0.5% previous.

- UK’s CBI Industrial Trends Survey Orders Nov 2018 (MoM) – Forecast -7, versus -6 previous.

- BOE’s Governor Carney speech.