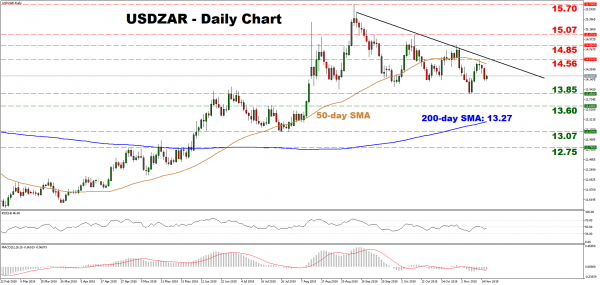

USDZAR has been printing lower highs and lower lows on the daily chart, below a downtrend line drawn from the highs of September 6. The pair has also recently fallen below its 50-day simple moving average (SMA), which has turned the near-term outlook cautiously negative.

Short-term oscillators are hovering in bearish territory, albeit not decisively so. The RSI is only marginally below its neutral 50 line and pointing sideways. Likewise, although the MACD is below zero, it still lies fractionally above its red trigger line.

Should the pair decline further, support may come near 13.85, the low of November 7. A downside break could open the way for the 13.60 area, marked by the peak of July 19, with even steeper declines aiming for the 200-day SMA at 13.27. Another bearish move below the latter would turn the outlook to firmly negative, setting the stage for a test of 13.07 – the July 31 trough.

On the upside, resistance to advances may be found near the crossroads of the downtrend line and the 14.56 level. A move above this zone could see scope for a test of 14.85, the October 31 high, before the October 9 peak of 15.07 comes into view.

In summary, as long as price action remains below the downtrend line, the short-term picture is cautiously bearish. A move below the 200-day SMA is needed to turn it decisively negative.