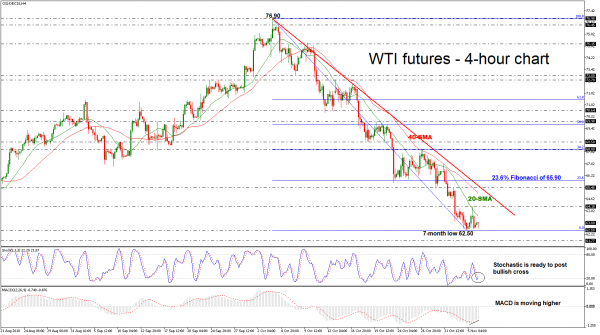

WTI crude oil futures sank to a new seven-month low of 62.51 on Monday, recording the sixth consecutive bearish day. Prices remain below the simple moving averages (SMAs) in the 4-hour chart and are hovering slightly above the aforementioned low.

Having a look at the technical indicators, the blue %K line of the stochastic oscillator is turning up, ready to create a bullish crossover with the red %D line. Moreover, the MACD oscillator stands above the trigger line in negative territory. These are signaling a potential change of momentum to the upside in the short-term and the very short-term.

Should the price manage to strengthen its negative bias and post a significant leg below the seven-month low, the next support could come around 61.77, taken from the low on April 6. A break below this area would shift the bias to a more negative one and open the way towards the 60.15 barrier.

On the flipside, if prices rebound from the recent low, they could touch the 20-SMA near 63.44 at the time of writing, before heading towards the 64.10 resistance level. Further improvement could drive oil prices until 65.40, given that the 40-SMA at65.00 is broken first. A penetration of this hurdle could send the price even higher until the 23.6% Fibonacci retracement level of the downleg from 76.90 to 62.50, around 65.90, breaking the short-term descending trend line to the upside.

To summarize, WTI crude shifted the bullish outlook to negative, especially after the slip below the 64.00 psychological level. In the short-term, the price has been mostly declining since October 3.