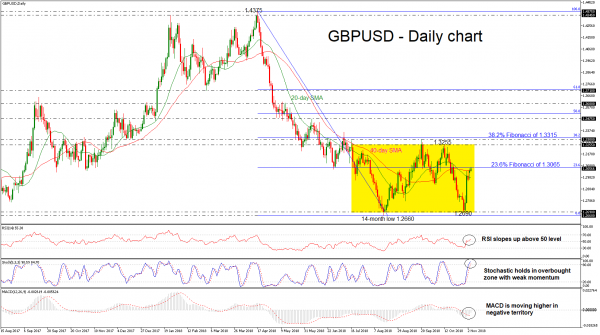

GBPUSD had an impressive bullish rally in the preceding week, while it continues the run, touching the 23.6% Fibonacci retracement level of the downleg from 1.4375 to 1.2690, near 1.3065, earlier today. Also, cable surpassed the 20- and 40-simple moving averages (SMAs) in the daily timeframe, confirming the recent upside movement.

Momentum indicators are pointing to a positive bias in the short term with the RSI heading upwards above the threshold of 50 and the MACD strengthening its upside momentum in the negative territory. However, the stochastic oscillator holds in the overbought zone but with weak momentum as its turning slightly to the downside.

In the event of further improvement above the 23.6% Fibonacci mark, the way could open towards the 1.3255 resistance level, taken from the latest highs on October 12. A break above this level would re-challenge the 1.3300 – 1.3315 zone, identified by the peak on September 20 and the 38.2% Fibonacci region.

Should prices stop around the 23.6% Fibonacci and reverse lower, immediate support could come from the 20-SMA of 1.2975. Below that, the 1.2690 is the next major barrier for the bears, where any violation would shift bias back to negative. Slightly below this level, the price could slip until the 14-month low of 1.2660, achieved on August 15.

Having a look at the longer picture, GBPUSD creates a descending structure, however, in the short-term the price is in consolidation almost four months, with upper boundary the 1.3255 resistance and lower boundary the 1.2690 support level.