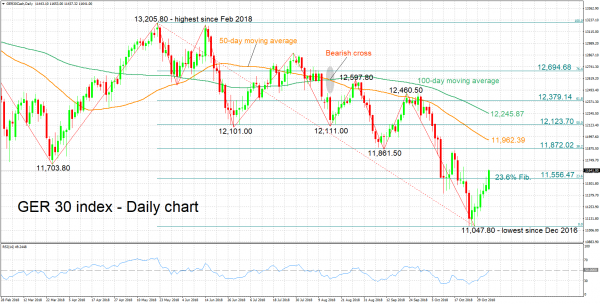

The Germany 30 index advanced by roughly 600 points after hitting its lowest since December 2016 at 11,047.80 in late October. Moreover, the benchmark is looking set to record its seventh straight day of gains on Friday, having touched an 11-day high of 11,660.30 earlier in the day.

Indicative of the bullish bias in the short-term is the upward-sloping RSI; the indicator sharply reversed course after entering oversold territory below 30.

Stronger gains may meet resistance around 11,872.02, the 38.2% Fibonacci retracement level of the downleg from 13,205.80 to 11,047.80. Notice that the region around this point captures a couple of bottoms from previous months as well as the current level of the 50-day moving average line at 11,962.39. A decisive move above, which would also allow the index to break above the 12,000 handle, would turn the focus to the zone around 12,123.70, the 50% Fibonacci mark.

On the downside, immediate support could occur at 11,556.47, this being the 23.6% Fibonacci level. Steeper losses would again bring within scope the benchmark’s near two-year nadir of 11,047.80.

Despite the recent advances, the medium-term picture remains bearish: the index is in a downtrend, recording lower highs and lower lows, while trading activity is taking place below the 50- and 100-day MAs, which maintain a negative slope.

Overall, the near-term outlook is looking bullish at the moment and the medium-term one continues to be negative.