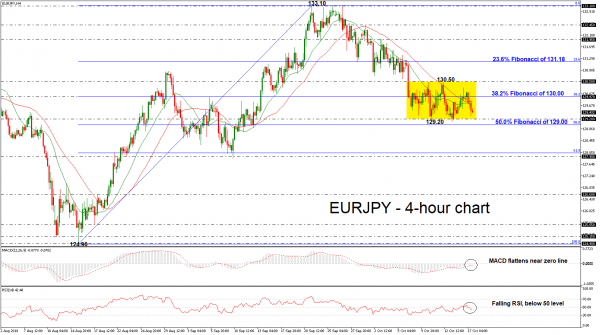

EURJPY has been trading within a consolidation area in the very near term with upper boundary the 130.50 resistance level and the lower boundary the 129.20 support hurdle since October 8. The price headed lower in the previous session and is supported by the technical indicators. The RSI is moving south in the negative zone, while the MACD oscillator hovers near the zero line.

If prices are able to continue to move lower the next support for traders to watch is the 129.20 barrier. Even lower, the pair could meet the 50.0% Fibonacci retracement level of the upleg from 124.90 to 133.10, around the 129.00 handle, while the next obstacle could come from the 61.8% Fibonacci of 128.00.

However, if the market manages to turn to the upside above the 38.2% Fibonacci of 130.00, the price could move towards the upper boundary of the range at 130.50. A break above this region could open the way towards the next resistance – the 23.6% Fibonacci of 131.18.

Looking at the near-term picture, at the 4-hour chart, EURJPY has been trading within a short-term downtrend over the last three weeks after the price bounced off the 133.10 resistance level.