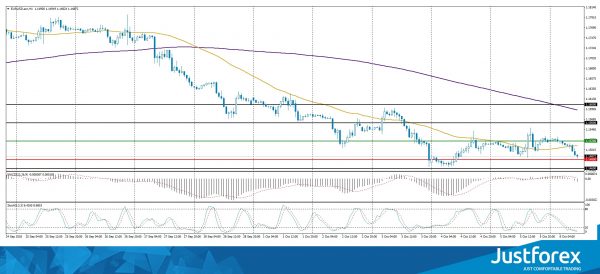

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.15147

Open: 1.15225

% chg. over the last day: +0.08

Day’s range: 1.14951 – 1.15049

52 wk range: 1.0571 – 1.2557

On Friday, there was a variety of trends on the EUR/USD currency pair. Mixed data on the US labor market for September were published. Thus, the number of people employed in the nonfarm sector slowed down to 134K, while investors expected a value of 185K. The growth of average hourly wages met market expectations and counted to 0.3% (m/m). Meanwhile, the unemployment rate fell from 3.9% to 3.7%. At the moment, the key support and resistance levels are: 1.14800 and 1.15200, respectively. Positions should be opened from these marks.

The news feed on the economy of the Eurozone and the US is calm.

The price has fixed below 50 MA and 200 MA, which indicates the power of sellers.

The MACD histogram has moved into the negative zone, which signals the bearish sentiment.

The Stochastic Oscillator is in the oversold zone, the %K line is crossing the %D line. There are no accurate signals.

Trading recommendations

Support levels: 1.14800, 1.14400

Resistance levels: 1.15200, 1.15600, 1.16000

If the price fixes above the resistance level of 1.15200, the EUR/USD quotes are expected to grow. The movement is tending to 1.15600-1.16000.

An alternative may be a further decrease in the EUR/USD currency pair to the level of 1.14400-1.14200.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.30190

Open: 1.31169

% chg. over the last day: +0.79

Day’s range: 1.30677 – 1.30843

52 wk range: 1.2361 – 1.4345

On Friday, aggressive purchases were observed on the GBP/USD currency pair. The British pound strengthened against the US dollar after statements by the EU’s chief negotiator, Michel Barnier, that they were ready to offer the UK a “unique” deal that was better and more beneficial than the previous one. At the moment, quotes are declining. The key support and resistance levels are: 1.30500 and 1.31000, respectively. Positions should be opened from these marks.

Today, the news feed on the UK economy is calm.

Indicators do not send accurate signals: 50 MA has crossed 200 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy GBP/USD.

The Stochastic Oscillator is in the oversold zone, the %K line is crossing the %D line. There are no accurate signals.

Trading recommendations

Support levels: 1.30500, 1.30000, 1.29600

Resistance levels: 1.31000, 1.31400, 1.31800

If the price fixes below the “mirror” support of 1.30500, it is necessary to consider sales of GBP/USD. The movement is tending to the round level of 1.30000.

An alternative may be the growth of the GBP/USD currency pair to the level of 1.31000-1.31300.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.29207

Open: 1.29441

% chg. over the last day: +0.09

Day’s range: 1.29905 – 1.29910

52 wk range: 1.2059 – 1.3795

The USD/CAD currency pair continues to show positive dynamics. During Friday’s and today’s trading, the growth of quotes have counted to more than 80 points. At the moment, the trading instrument is testing the round level of 1.30000. The key support is the 1.29600 mark. Positions should be opened from these marks. The USD/CAD currency pair has the potential for further growth.

The news feed on the economy of Canada is calm.

The price has fixed above 50 MA and 200 MA, which indicates the power of buyers.

The MACD histogram is in the positive zone, above the signal line, which gives a strong signal to buy USD/CAD.

The Stochastic Oscillator is in the overbought zone, the %K line is crossing the %D line. There are no accurate signals.

Trading recommendations

Support levels: 1.29600, 1.29150, 1.28700

Resistance levels: 1.30000, 1.30400, 1.30800

If the price fixes above the resistance level of 1.30000, further growth of the USD/CAD currency pair is expected. The movement is tending to 1.30400-1.30600.

Alternative option. If the price fixes below 1.29600, it is necessary to consider sales of USD/CAD. The movement is tending to 1.29200-1.29000.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 113.868

Open: 113.780

% chg. over the last day: -0.18

Day’s range: 113.703– 113.746

52 wk range: 104.56 – 114.74

There is a variety of trends on the USD/JPY currency pair. Investors expect additional drivers. At the moment, the trading instrument is moving in flat. Local support and resistance levels are: 113.600 and 113.900, respectively. Positions should be opened from these marks. In the near future, technical correction of the USD/JPY quotes after a prolonged rally is not excluded.

The news feed on the economy of Japan is quite calm.

Indicators do not give accurate signals. Price has crossed 200 MA.

The MACD histogram is in the negative zone and continues to decline, which indicates the bearish sentiment.

Stochastic Oscillator is in the oversold zone, the %K line is below the %D line, which gives a weak signal to sell USD/JPY.

Trading recommendations

Support levels: 113.600, 113.300, 113.000

Resistance levels: 113.900, 114.200, 114.500

If the price fixes below the support level of 113.600, the USD/JPY currency pair is expected to decline. The movement is tending to 113.300-113.000.

An alternative may be the growth of the USD/JPY quotes to the level of 114.000-114.200.