The USD/CAD currency pair has dropped from the S1 pivot point support after OPEC (The Organization of the Petroleum Exporting Countries) output has rose by 90K bpd in September. Iran’s production might fall further after the Nov 4 US sanctions hit. Bloomberg also reported that India has no plans to purchase Iran’s oil starting in November with South Korea and Japan pledging the same. The only scheduled news that might affect oil is on Wednesday, for Crude Oil inventories. They represent a change in the number of barrels of crude oil held in inventory by commercial firms during the past week. Don’t forget to follow our Forex calendar for all regular updates on the news, economic announcements, forecasts and much more.

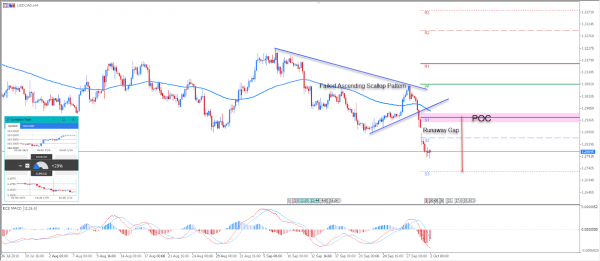

Technically, the USD/CAD currency pair has formed a runaway gap .The runaway gaps are usually accompanied by strong volatile candles such as the marubozu candle which support the market’s price sentiment in the direction of the trend. The emerging pattern which we can spot here is the ‘Failed Ascending Scallop’ pattern. The price might possibly drop from the S2 or S1 pivot point resistance on a retest- 1.2863 or 1.2939. If that happens, be prepared for a volatile ride towards the S3 support at 1.2726. If the runaway gap is closed, then another push straight towards the S3 pivot might be expected even without a retest of S2 or S1 pivot. As always, be prepared to react using price action tools as usual.

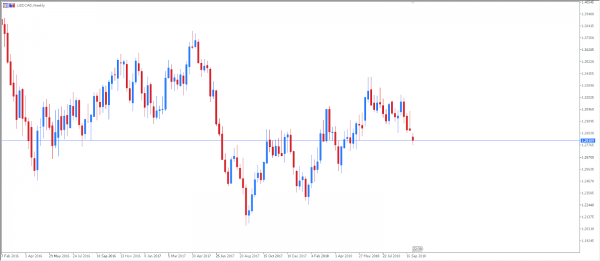

Pivot Lines – Weekly Support and Resistance

POC – POC – Point Of Confluence (The zone where we expect the price to react – aka the entry zone)