‘We think that a continued improvement in US economic data and a Fed that acknowledges this should push the USD back into its uptrend.’ – Morgan Stanley (based on PoundSterlingLive)

Pair’s Outlook

The Cable behaved mostly according to expectations on Tuesday, as it experienced another decline, but stabilised below the immediate support area. Since the GBP/USD pair still remains in its consolidation trend, the most logical outcome today would be a rally back towards the 1.25 level or even higher. A drop lower is also possible, but with a close above the 1.2450 level, as it kept the Sterling afloat since mid-January. Moreover, the monthly PP, the 55 and the 100-day SMAs form a tough demand cluster just below the 1.2450 mark, also suggesting a strong bearish development is far-fetched. Meanwhile, technical indicators are in favour of the positive outcome.

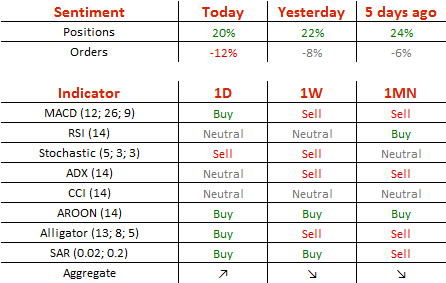

Traders’ Sentiment

There are 60% of traders with a positive outlook towards the Pound today, but 56% of all pending orders are to sell the British currency.