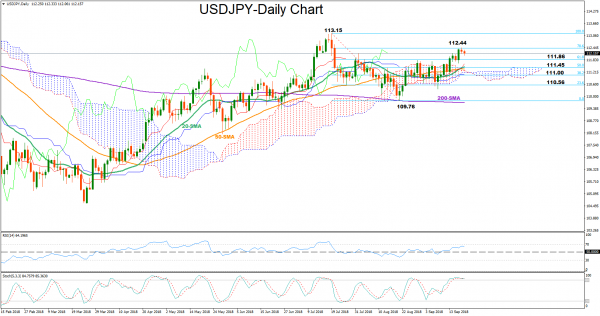

USDJPY approached overbought levels according to the RSI and the Stochastics and pulled back after touching a two-month high of 112.44 on Wednesday, which is also a shy above the 78.6% Fibonacci retracement of the downleg from 113.15 to 109.76.

In the short-term the trend is likely to hold on the upside as the price continues to trade above the cloud, while positive signals also come from the 20-day (simple) moving average (MA) which is set to climb back above the 50-day MA. The price however could consolidate as the RSI moves closer to its neutral threshold of 50.

Should the market extend losses, the 61.8% Fibonacci of 111.86 could offer nearby support ahead of the 50% Fibonacci of 111.45, where the 20-day and the 50-day MA as well as the top of the Ichimoku cloud are located. Below from here, bears could cross under the 111 round level, to test the area around 110.56, the 23.6% Fibonacci. The latter would also send the price below the cloud, a sign that a downtrend could resume.

On the other hand, if bulls retake control, the price may revisit yesterday’s peak of 112.44, while if this fails to halt upside movements, the way could open towards the 113.15 top marked on July 19. Steeper increases have the potential to violate that roof, with scope to meet the 114.72, the high taken from November 5 2017.

In the medium-term picture, the market is trading in a range with a high at 113.15 and a low at 109.76. Any significant break of these boundaries could change the outlook accordingly. Yet chances for a bullish market are higher as long as the 50-day MA moves above the longer-term 200-day MA.