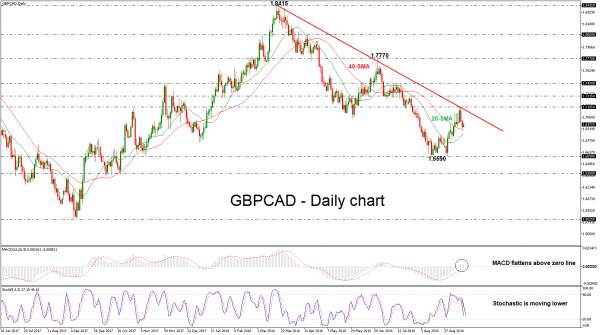

GBPCAD has lost its positive momentum after the bounce off the medium-term descending trend line at 1.7185 on Monday. In the short-term, the market could retain the bearish structure as the MACD is flattening above the zero and trigger lines, while the stochastic oscillator is moving lower. Despite those signs, the 20-day simple moving average (SMA) is ready to cross to the upside of the 40-day SMA in the next few sessions in case of a bullish movement.

Should the pair stretch south and plunge below the moving averages, the 1.6590 barrier could provide immediate support to investors. A significant step lower could create a new lower low sending the price probably towards the 1.6380 hurdle, identified by the bottom on October 2010.

On the other hand, if the pair strengthens, the price could re-challenge the falling trend line and the 1.7185 resistance obstacle. Even higher, the 1.7315 could attract greater attention as any leg higher could endorse the scenario for a bullish retracement, opening the way towards the 1.7470 hurdle, taken from the highs on July 16.

In the medium-term picture, GBPCAD has been trading bearish in the past six months after the close below 1.8415. Still, if the pair manages to cross above 1.7185 the bearish outlook could switch to a bullish one.