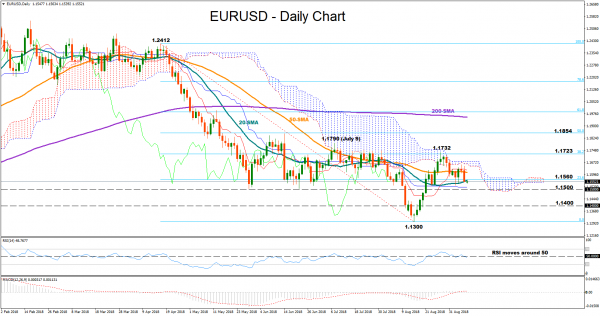

EURUSD closed below the 1.1600 key level after a negative session on Friday, though the pair remains neutral since the end of August, trading between 1.1529- 1.1732. In the short-term, consolidation is likely to stay in place as the RSI continues to move around its 50 neutral mark and the MACD holds around zero and its red signal line.

A leg higher could meet immediate resistance at the 23.6% Fibonacci of the downleg from 1.2412 to 1.1300, near 1.1560 where the 20-day simple moving average is currently located. Further up, the area between the 38.2% Fibonacci of 1.1723 and July 9’s peak of 1.1790 could be the next target ahead of the 50% Fibonacci of 1.1854, which if successfully broken, bullish actions could gain stronger momentum, potentially confirming the start of an uptrend.

In the alternative scenario, an extension to the downside may find a challenge at 1.1500 which the market was unable to breach a couple of times since the end of May. However, if the price manages to cross below that point, traders could look for support around 1.1400 before eyes turn to the 1.1300 bottom.

In the medium-term picture, the pair has been lacking direction over the past three months, a status which is not expected to change into a bullish one unless the price breaks above the 50% Fibonacci of 1.1854. A bearish outlook could resume below 1.1300.

To sum up, EURUSD outlook is neutral both in the short and the medium-term picture