Key Highlights

- The US Dollar traded higher this week and settled above the 110.80 resistance against the Japanese Yen.

- There was a break above an important bearish trend line with resistance at 110.86 on the 4-hour chart of USD/JPY.

- The US Personal Income in July 2018 increased 0.3% (MoM), less than the last increase of 0.4%.

- Tokyo’s Consumer Price Index ex Fresh Food in August 2018 increased 0.9% (YoY), more than the +0.8% forecast.

USDJPY Technical Analysis

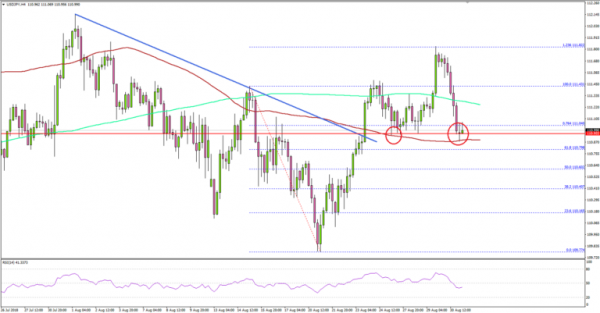

The US Dollar formed a key bottom at 109.77 recently against the Japanese Yen and started an upward move. The USD/JPY pair broke the 110.50 and 110.80 resistances to move into a positive zone.

Looking at the 4-hours chart, the pair traded above the 111.00 resistance and settled above the 100 simple moving average (red). There was even a break above the last swing high at 111.43.

The pair climbed higher and tested the 1.236 Fib extension level of the last slide from the 111.43 high to 109.77 low. It acted as a resistance area near 111.80, resulting in a short-term correction. On the downside, there are many supports above 110.80 and the 100 SMA.

Recently, the pair broke an initial support near the 200 simple moving average (green, 4-hours) and 111.20. It is currently testing the 100 SMA (currently at 110.87) and the 110.80 support area. Below 110.80, the pair could move back towards the 110.50 level.

On the upside, the pair may struggle to break the 111.70-80 resistance zone. Once buyers succeed, the pair could trade towards the 112.00 level in the near term.

Fundamentally, the US Personal Income report for July 2018 was released by the Bureau of Economic Analysis, Department of Commerce. The market was looking for a rise of 0.3% in income compared with the previous month.

The actual result was similar to the forecast, but it was less than the last increase of 0.4%. Looking at the personal spending, there was a rise of 0.4%, similar to the forecast and the last reading.

Overall, the US Dollar remains supported on dips versus the Japanese Yen, but pairs like EUR/USD and GBP/USD are likely to continue their upward move in the coming sessions.

Economic Releases to Watch Today

- German Retail Sales for July 2018 (MoM) – Forecast 0%, versus +1.2% previous.

- Euro Zone CPI for August 2018 (YoY) (Prelim) – Forecast +1.1%, versus +1.1% previous.

- Euro Zone Core CPI for August 2018 (YoY) (Prelim) – Forecast +2.1%, versus +2.1% previous.

- Chicago Purchasing Manager’s Index for August 2018 – Forecast 63.0, versus 65.5 previous.