‘GBP/USD should be capped in front of raised range resistance (1.30-32) and is likely to slide back towards the centre of its 1.20-1.32 rang.’ – Westpac (based on FXStreet)

Pair’s Outlook

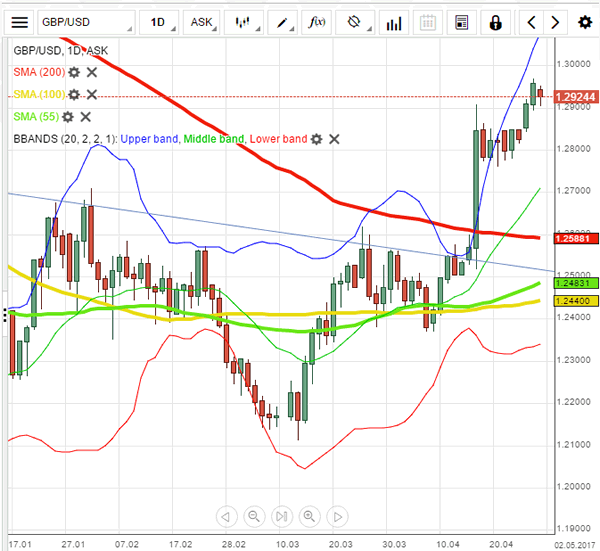

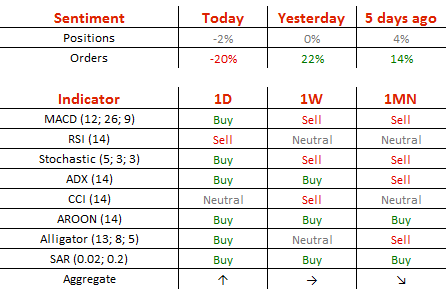

Substantially weak US GDP data on Friday allowed the British Pound to take the upper hand and experience another leg up. As a result, the Cable got close to retesting the broadening rising wedge’s resistance line, thus, a U-turn today is the most probable outcome. The weekly pivot point is providing immediate support just under the 1.29 mark, but losses are expected to exceed this level, with focus falling on the weekly S1 at 1.2829. However, technical indicators in the daily timeframe are giving distinctly bullish signals, suggesting a close in the green zone is possible. There is room for a rally, where the 1.30 handle is likely to be the intraday ceiling.

Traders’ Sentiment

There are 51% of traders holding short positions today (previously 50%), while 60% of all pending orders are to sell the Buck.