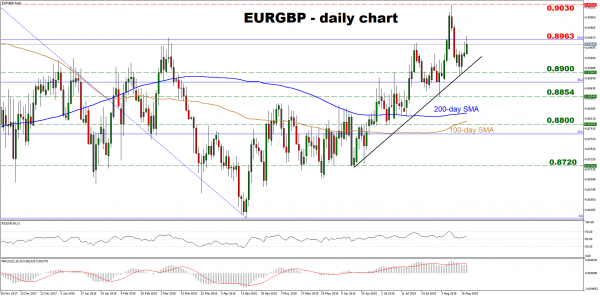

EURGBP retreated in recent days, after meeting resistance near the 10-month high of 0.9030 recorded on August 9. Despite the pullback, the price structure on the daily chart remains higher peaks and higher troughs above the uptrend line drawn from the lows of June 15, as well as above the pair’s 100- and 200-day moving averages. These suggest that the broader bullish trend is still in force.

Looking at short-term momentum oscillators, they are also in support of a broadly positive picture. The RSI – already above its neutral 50 line – is pointing upwards, detecting upside momentum. The MACD, meanwhile, although slightly below its red trigger line, remains safely in positive territory.

In case of further advances, a clear closing candle above the 0.8963 barrier, which is the 50% Fibonacci retracement of the 0.9300 to 0.8620 downleg, could open the way for the multi-month low of 0.9030. Even steeper advances could see scope for a test of the 0.9100 round figure.

On the downside, support to declines may come near the crossroads of the 0.8900 handle and the aforementioned upside support line. If the bears overcome that barrier, declines could stall near the 0.8854 level, this being the low of August 2. Even lower, the 200- and 100-day moving averages could provide support, at 0.8821 and 0.8806 respectively, with the area around them also encapsulating the psychological number of 0.8800.

Overall, the short-term picture remains bullish, though the medium-term outlook of the pair is largely neutral, with a break above 0.9030 needed to turn that to positive as well.