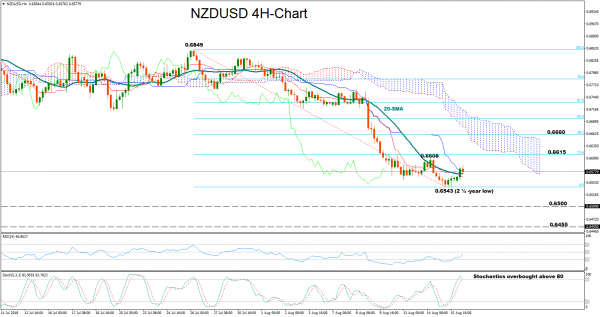

NZDUSD paused its steep downfall at the 2 ½-year low of 0.6543 on Wednesday, reversing higher to recover losses made earlier this week. The RSI in the 4-hour chart stretched to the upside as well and is set to test its neutral 50 mark for the first time in 8 days after dropping below 30 in oversold territory. While this increases the chances for further recovery, the fast stochastics suggest that negative corrections are not unlikely as the green %K line is looking on track to break below the red %D line in overbought territory.

If bearish pressures dominate, the price could touch the bottom created around 0.6543, where a leg lower could look for support around the 0.6500 psychological level, bringing the downtrend from 0.6849 back into play. Steeper declines could also meet support at 0.6455, a previous resistance area in September 2015.

On the other hand, if the market extends its recovery, bulls could stop around Tuesday’s high of 0.6608, which is located marginally below the 23.6% Fibonacci of 0.6615 of the upleg from 0.6849 to 0.6543. Further above, traders could speculate that the steep downfall from 0.6849 has completed and further upside may follow. In this case, the attention would turn to the 38.2% Fibonacci of 0.6660.