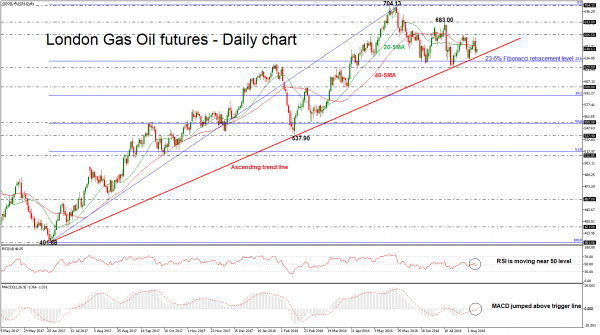

London Gas Oil futures have reversed back up again after finding support near the long-term ascending trend line. After the pullback on the 704.13 resistance level, the price came under pressure and started a downside rollercoaster. However, the weak picture in the short-term is further support by the technical indicators. But the technical indicators now support that the market could develop sideways in the short-term as the RSI holds near its neutral threshold of 50 and the MACD lies pretty close to zero and its red signal line.

In the wake of negative pressures, the market could meet support at the 23.6% Fibonacci of the upleg from 401.88 to 704.13, around 633.10. This level stands below the uptrend line and should the market cross below that level too, downside corrections could increase momentum. Next level for investors to have in mind is the 600.00 strong psychological barrier.

On the other side, an extension to the upside could retest the 20- and the 40-day simple moving averages before it meets 666.50, taken from the latest highs. However, a stronger barrier could be found at the 683.00 hurdle, where the price topped on July 10.

Having a look at the bigger picture, the price has been trading within an ascending movement since June 2017, testing the line several times in the past. Should the price continue to move along the line, bullish outlook could stay in play.