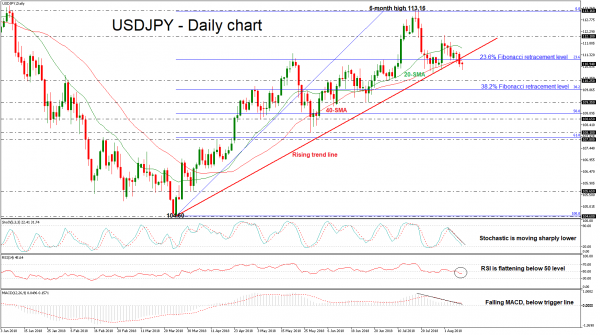

USDJPY edged sharply lower over Wednesday’s session as it penetrated the medium-term ascending trend line to the downside. Also, the price successfully dropped below the simple moving averages and the 23.6% Fibonacci retracement level of the upleg from 104.60 to 113.16, around 111.13. The technical indicators confirm the bearish retracement mode in the price action.

Looking at the daily timeframe, the stochastic oscillator plummeted near the oversold zone, while the RSI indicator is flattening below the threshold of 50. Moreover, the MACD oscillator is moving lower below the trigger line but remains in the positive area.

Further downfall movement could drive the price until the immediate support of the 110.25 hurdle, taken from the lows at the beginning of July. A break of this level could extend the south move until the 38.2% Fibonacci of 109.90 before being able to touch the 109.35 barrier.

Should investors turn the focus to the upside again and the price jumps above the aforementioned strong obstacles, such as 23.6% Fibonacci and moving averages, this would open the way towards the latest high of the 112.10 resistance level. Further advances above this level, could then target the area around the six-month high of 113.16.

To sum up, USDJPY ended the day below the medium-term ascending trend line, which has been holding since March 26, endorsing the scenario for a new bearish rally.