Key Highlights

- The Aussie Dollar declined heavily in June 2018 and traded towards 0.7300 against the US Dollar.

- There is a crucial bearish trend line in place with resistance at 0.7500 on the daily chart of AUD/USD.

- The US Personal Income in June 2018 increased 0.4% (MoM), in line with the market forecast.

- Today, the Fed Interest rate decision is scheduled, and the central bank is likely to keep rates at 2%.

AUDUSD Technical Analysis

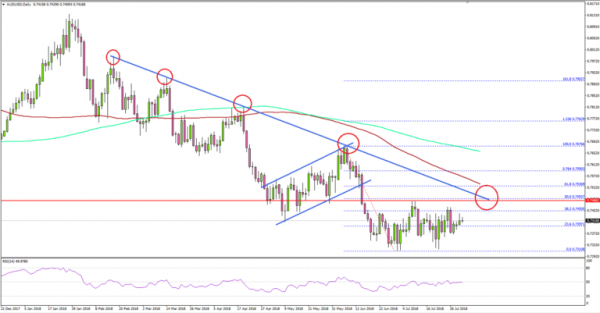

The Aussie Dollar remained in a major downtrend from the 0.7670 swing high against the US Dollar. The AUD/USD pair recently formed support near 0.7310 and recovered, but upsides remained capped.

Looking at the daily chart, the pair recovered above the 23.6% Fibonacci retracement level of the last decline from the 0.7670 swing high to 0.7310 swing low. However, the previous support area near 0.7490-0.7500 acted as a resistance.

Additionally, the 50% Fibonacci retracement level of the last decline from the 0.7670 swing high to 0.7310 swing low also acted as a resistance. More importantly, there is a crucial bearish trend line in place with resistance at 0.7500 on the same chart.

Therefore, it won’t be easy for the Aussie dollar to break the 0.7490 and 0.7500 resistance levels. Above 0.7500, the 100-day simple moving average (red) is positioned at 0.7540. As long as AUD/USD is below 0.7500 and the 100-day SMA, it may perhaps either consolidate or move down towards 0.7200.

On the flip side, a close above 0.7500 and the 100-day SMA could push the pair in a positive zone towards the 0.7600 and 0.7700 levels in the medium term.

Recently in the US, the Personal Income for June 2018 was released by the Bureau of Economic Analysis, Department of Commerce. The market was looking for a 0.4% rise the personal income compared with the previous month.

The actual result was in line with the forecast and similar to the last reading. Looking at the Core Personal Consumption Expenditure in June 2018, there was a rise of 1.9%, less than the forecast of 2%.

Overall, AUD/USD is facing an uphill task near 0.7500. However, today’s fed rate decision could ignite swing moves in pairs like EUR/USD, GBP/USD, AUD/USD, USD/JPY and NZD/USD.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for July 2018 – Forecast 57.3, versus 57.3 previous.

- Euro Zone Manufacturing PMI July 2018 – Forecast 55.1, versus 55.1 previous.

- UK Manufacturing PMI for July 2018 – Forecast 54.2, versus 54.4 previous.

- US Manufacturing PMI for July 2018 – Forecast 55.5, versus 55.5 previous.

- US ADP Employment Change July 2018 – Forecast 185K, versus 177K previous.

- US ISM Manufacturing Index for July 2018 – Forecast 59.8, versus 60.2 previous.

- Fed Interest Rate Decision – Forecast 2%, versus 2% previous.