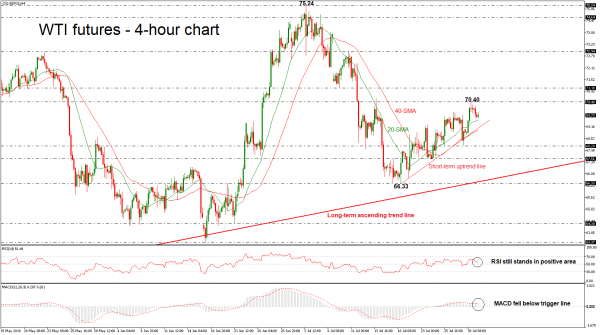

WTI futures have been standing above the short (since July 18) and long-term (since June 21, 2017) ascending trend lines suggesting a possible strong upside momentum after the strong bounce off the 75.24 resistance level. However, over today’s session, the price posts limited losses approaching the 20-simple moving average (SMA) of 69.46 in the 4-hour chart.

The RSI indicator and the MACD oscillator have both weakened, with the former holding near its neutral threshold of 50 and the latter easing below its red signal line. Still, upside risks have not faded out yet as both indicators continue to fluctuate in the bullish territory; the RSI above the 50 level and the MACD above the zero line.

Should the price shift above the 70.40 barrier, traders could look for resistance at the 71.10 hurdle, where bulls could push hard to extend this level. In this case, the oil could touch the 72.94 resistance level, taken from the peak on July 10.

On the flip side, a decline could find support at the short-term uptrend line, near 69.20, which stands near the 40-SMA while if the bearish moves appear stronger, the price could hit the 68.20 support. A failure to hold above this level could open the door for the 67.56 barrier.

Overall, crude oil remains in a positive mode, despite the latest pullback in the short-term, as it still stands above the moving averages.