Two weeks ago, the price of Ethereum rose to a multi-monthly high of $505. The rise was in line with the surge in other cryptocurrencies like Bitcoin and Litecoin. It came after the earnings release of major financial firms, including Blackrock. The firm announced that it would set up a team to explore investments in the cryptocurrencies industry. Afterwards, traders started to focus on the regulations and whether the US regulator would accept proposals for cryptocurrencies ETFs.

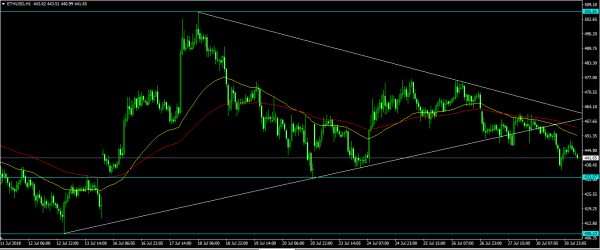

After reaching the $505 high, Ethereum was unable to hold above the important $500 level. Since then, the ETH/USD pair has dropped to a weekly low of $432 and is currently trading at $443.

Yesterday, the Commonwealth Bank of Australia announced that it had completed the first blockchain-powered shipping experiment. The experiment involved shipping 17 tonnes of almonds from Australia to Germany. The experiment also included five other Australian and international leaders in the supply chain. This experiment demonstrated a blockchain platform using Ethereum’s technology of smart contracts and distributed ledger. It also used the concept of Internet of Things (IoT). Combined, these technologies facilitated the tracking of shipping and the end delivery along the existing processes.

This was a good demonstration of how the concept of blockchain can help companies around the world speed the documentation, operations, and finance.

On the hourly chart below, the ETH/USD pair is trading below the 50 and 100-day Exponential Moving Averages. In the past few days, the pair has been in consolidation mode, which has led to the creation of a symmetrical triangular pattern. This pattern was broken yesterday when the pair fell below the $450 level. In the coming days, traders will wait for any news from the SEC on the ETF proposal submitted by VanEck. A positive outcome will likely see the ETH/USD pair resume upward movements.