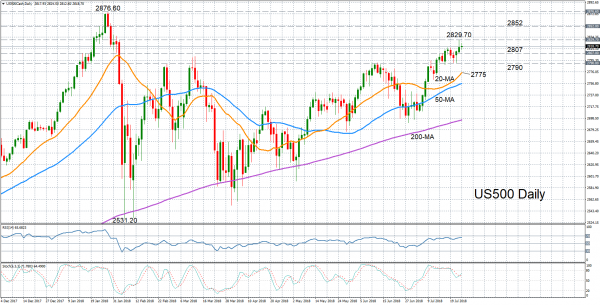

The US 500 stock index (cash) reached a near 6-month high of 2829.70 on Tuesday, with the index now having retraced about 80% of its January/February losses. The near-term bias remains strongly bullish according to the momentum indicators. The RSI is climbing and has yet to rise into overbought territory, while the %K line of the stochastic oscillator recorded a bullish crossover with the slower moving %D line. Both indicators suggest there is scope for additional gains in the short term.

The nearest obstacle for price action to move higher is yesterday’s high of 2829.70. A climb above this level could see the next resistance coming at around the 2852 level. Clearing this hurdle would set the index on path to beat its all-time high of 2876.60 achieved in January. Breaking above this top would take prices into record territory and signal the end of the medium-term consolidation phase, shifting the outlook to bullish.

However, should disappointing earnings results trigger a downside correction, immediate support should come from around 2807. A drop below this mark could see the index heading back towards the recent support area of 2790. A steeper sell-off would push prices towards the 20-day moving average at 2775. A breach of this support would risk switching the near-term bias from bullish to bearish.