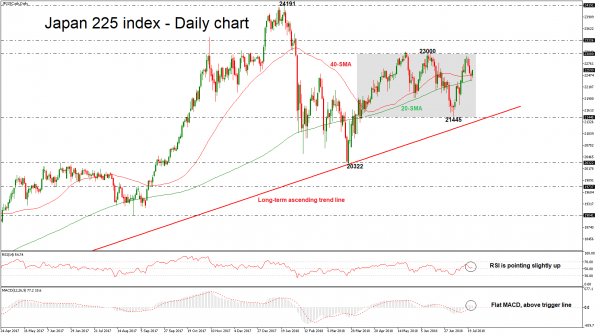

Japan 225 index is paring some of the previous three days’ losses after the bounce off the 20-day simple moving average (SMA). Having a look at the medium-term picture the price has been developing within a consolidation area since April with upper boundary the 23000 handle and lower boundary the 21445 support.

Momentum indicators in the daily chart are currently supporting the neutral to positive momentum and are likely to strengthen in the short-term. Specifically, the RSI is picking up speed above 50, while the MACD continues to move sideways above its trigger and zero lines.

Should the price decisively close above the ceiling of the trading range, seen at 23000, bulls could extend the latest upswing towards 23336. If there are further advances above this level, the index could then target the area around 24191 which had successfully halted upside movements during January.

On the other side, a decline could meet the 20-day moving average at 22366 and a successful drop below this level could push the index towards the lower boundary (21445). A breach of this area would open the door for the 20322 support zone.

To sum up, Japan 225 index has been standing above a long-term ascending trend line over the last two years but has struggled in a trading range over the past three months.