‘We read the technical indicators as suggesting there is scope for addition gains, but suspect the $1.3000-$1.3050 may be difficult to overcome.’ – BBH (based on FXStreet)

Pair’s Outlook

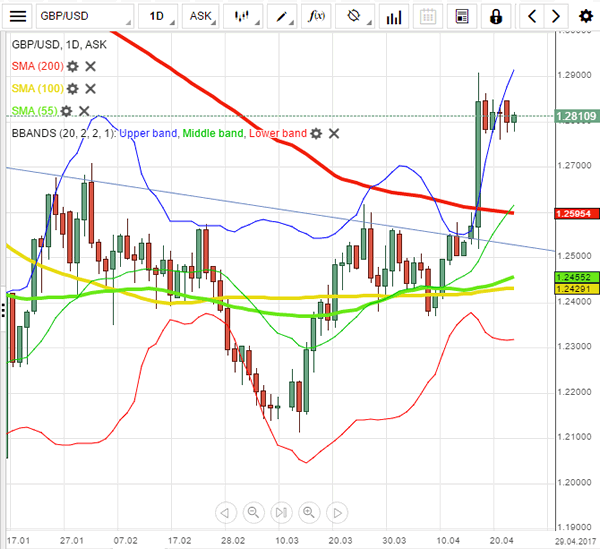

As was anticipated, the Sterling began the week on the back foot, having lost 45 pips against the US Dollar yesterday. The decline was a good sign, as it confirmed the Cable’s current consolidation trend, which began after last week’s strong 278-pip surge. The GBP/USD pair remains anchored to the 1.28 major level, thus, no significant development is expected to occur today. However, according to technical indicators, the bullish momentum today is likely to prevail, but with the 1.2850 mark still being the intraday ceiling, as it marks the consolidation trend’s upper boundary.

Traders’ Sentiment

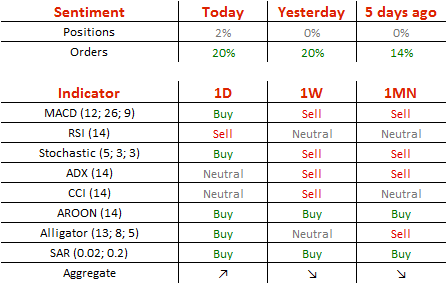

Bulls and bears finally broke out of equilibrium, but market sentiment still remains neutral, with 51% of all open positions being long. Meanwhile, the number of purchase orders remains unchanged at 60%.