Cable holds in red and accelerated lower in in early European trading on Wednesday, extending previous day’s strong fall of nearly 1%.

Pound was initially hit by soft UK jobs data and additionally pressured by hawkish comments from Fed’s Powell which pushed the dollar significantly higher.

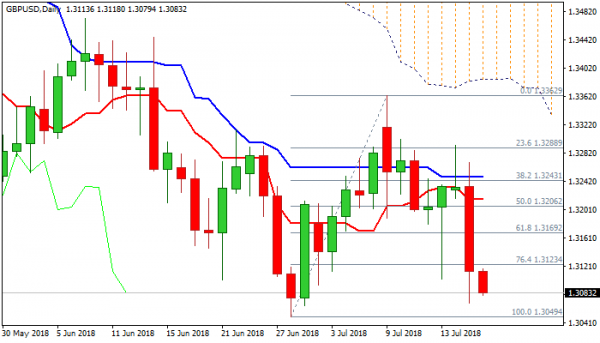

Tuesday’s fall broke below strong support at 1.3102 (last Friday’s spike low) and dipped to 1.3068, pressuring key support at 1.3049 (28 June low, the lowest since late Oct 2017). Bearish daily techs support further weakness for final attack at 1.3049 pivot, clear break of which would expose psychological 1.30 support and could accelerate towards next pivot at 1.2865 (Fibo 61.8% of larger 1.1930/1.4376 ascend).

Meanwhile, the pair may show stronger hesitation at key 1.3049 support and may bounce higher on better than expected UK inflation data, which are the key event for sterling today. Annualized inflation is forecasted to rise 2.6% in June vs 2.4% previous month, with release at/above the figure expected to give temporary boost to sterling.

Overall picture is bearish and bounce could be seen as positioning for fresh weakness, with upticks expected to stall under 1.3200 zone (falling 10/20SMA’s) to keep bears intact. Alternatively, stronger recovery which includes close above 1.32 handle, would sideline immediate downside threats.

Res: 1.3118, 1.3169, 1.3210, 1.3237

Sup: 1.3068, 1.3049, 1.3000, 1.2905