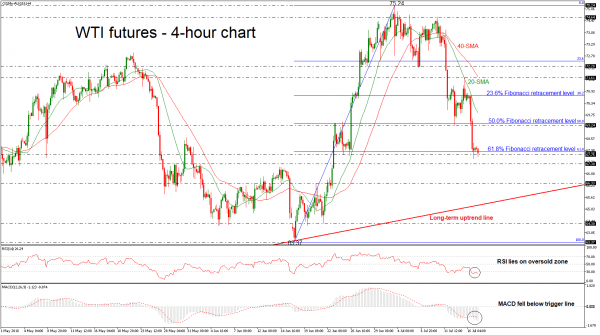

WTI futures for August delivery recorded a fresh more than three-week low of 67.56 on Monday, while the sharp bearish run started following the pullback on the 74.64 resistance level last Tuesday. Also, the price plunged below the 61.8% Fibonacci retracement level of the upleg from 63.37 to 75.24 of 67.90, indicating that a bearish movement is in play in the near term.

In the 4-hour chart, the momentum indicators are supportive of the bearish picture, with the RSI remaining into the oversold zone below 30 level, while the MACD oscillator is holding below its trigger and zero lines with strong momentum.

Immediate support is being provided by the 67.30 barrier. Moreover, should prices tumble lower again, the next support would likely come from the 66.33 level, taken from the high on June 20. A drop below this region would open the way towards the long-term ascending trend line near 65.50. A penetration of the diagonal line would signal the start of a deeper bearish phase.

In case of an upward attempt, WTI would likely meet resistance at the 69.24 hurdle, which holds near the 50.0% Fibonacci. A break above the latter level, would ease the downside pressure and push the price further higher until the 38.2% Fibonacci of 70.71.

Overall, having a look at the bigger picture, crude oil has been developing within a rising movement during the last year and the price is approaching this line over the last sessions.