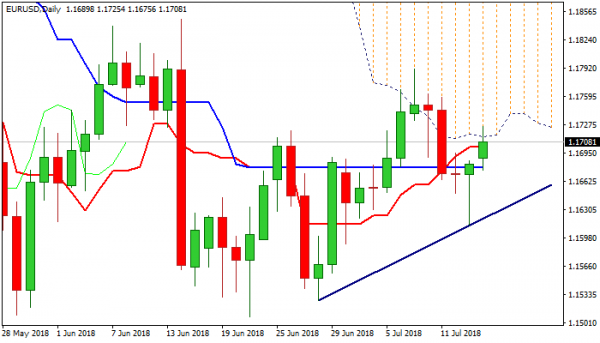

The Euro advanced further on Monday, extending bounce from last Friday’s low at 1.1613, where strong downside rejection occurred. Friday’s hammer signaled further recovery which resulted in extension and test of strong barrier at 1.1713, provided by daily cloud base, with initial probe through cloud base, being so far unsuccessful. Massive falling daily cloud produces strong pressure on the pair and could offset positive signals from hammer candle, bullishly aligned 14-d momentum and north-heading slow stochastic which reversed from the border of oversold territory. Daily MA’s (5; 10; 30) are in mixed setup while 20SMA marks pivotal support at (1.1659), while falling 55SMA (1.1634) capped today’s rally and reinforces cloud base barrier. Stronger direction signals could be expected on break of either pivotal barrier (upper at 1.1713/34, cloud base / falling 55SMA and lower at 1.1659, 20SMA). Near-term outlook for the single currency may weaken as solid US retail sales (Jun figures came in line with expectations but previous month’s numbers were revised significantly higher) giving fresh support to the greenback. With no significant releases from the EU scheduled today and on Tuesday, focus turns towards Tue/Wed Congressional testimony of Fed’s chief Powel, which could provide fresh hints about Fed’s next steps and further impact the dollar.

Res: 1.1713; 1.1734; 1.1758; 1.1790

Sup: 1.1695; 1.1659; 1.1613; 1.1589