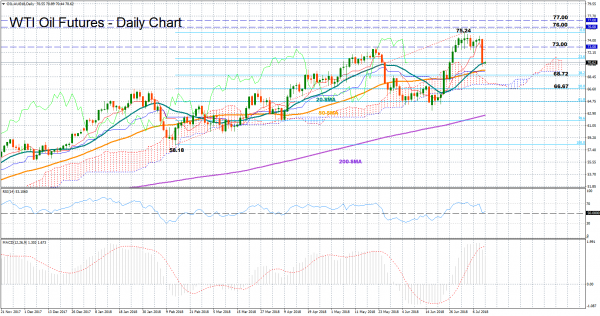

WTI crude oil futures (August delivery) had their worst day in a year yesterday losing nearly 5% in the wake of new trade threats from the US to China. The price, however, managed to stay above 70 yesterday, finding support at the 20-day moving average (MA) despite the sharp fall from 74.

Momentum indicators have weakened, with the RSI retreating towards its neutral threshold of 50 and the MACD distancing itself further below the red signal line, suggesting that weakness might persist in the market in the short-term. Yet upside risks have not faded yet as both indicators hold in bullish territory; RSI above 50 and MACD above zero.

Should the market reverse higher, resistance could be found near the 73-key level, where the price formed a floor in the past two weeks. Further up, bulls could test the 3 ½ -year high of 75.24, while a significant move above from here could strengthen the bullish outlook resuming the long-term upleg off 42.02 (June 2017). In this case, resistance could run towards the 76 and 77 psychological marks.

On the other hand, an extension to the downside could retest the area between the 50-day MA at 69.44 and the 38.2% Fibonacci of 68.72 of the upleg from 58.18 to 75.24. A drop below that could then meet a stronger obstacle at the 50% Fibonacci of 66.67 which has restricted upside and downside corrections in the past.

In the bigger picture the market continues to hold positive, printing higher highs and higher lows above the Ichimoku cloud.