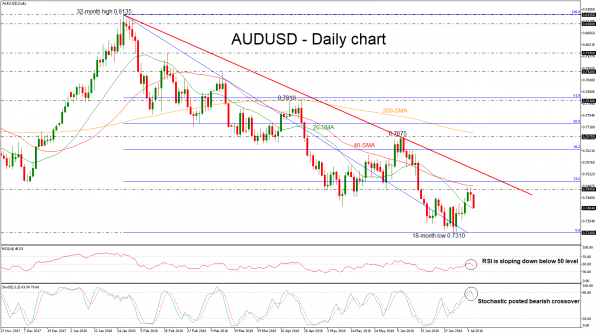

AUDUSD retreated after the pullback on the 0.7475 resistance level on Tuesday which is slightly below the 40-simple moving average (SMA) in the daily timeframe. The short-term technical indicators are bearish and point to more weakness in the market.

Currently, the price touched the 20-day SMA, which acts as a strong support level for the bulls. However, the RSI indicator is sloping downwards and stands below the threshold of 50, while the %K line of the stochastic oscillator completed a bearish crossover with the %D line in the overbought territory, suggesting a downward correction of the latest positive move is underway.

Should prices drop further lower, this could open the way towards the 0.7160 hurdle, identified by the trough on December 2016. There are no significant support obstacles before that level.

In case of further gains, the first resistance for investors to have in mind is the 0.7475 barrier, taken from the bottom on May 31. If there is a jump above this level, the price could challenge the 23.6% Fibonacci retracement level of 0.7505 of the downleg from 0.8135 to 0.7310. Above this region, if there is a break of the descending trend line, the focus shifts to the upside until the 38.2% Fibonacci of 0.7625.

To conclude, AUDUSD has been developing within a descending move since January 26 and is in progress to hit again the 18-month low of 0.7310 in the near term.