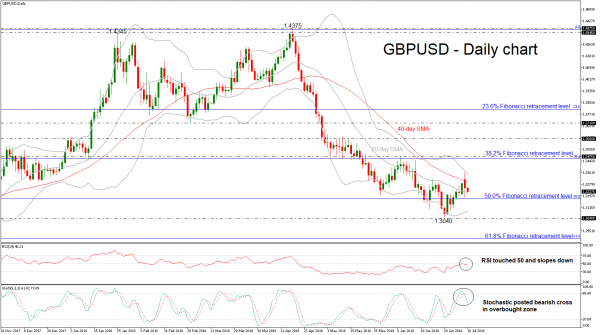

GBPUSD had an aggressive roller coaster move on Monday as it opened with a gap up and challenged a new one-month high, but finished the day in the red. Also, the cable almost touched the 50.0% Fibonacci retracement level of the upleg from 1.2100 to 1.4375, around 1.3180, but currently it remains above the 20-simple moving average (SMA) in the daily timeframe.

From the technical point of view, the Relative Strength Index (RSI) lost its positive momentum and bounced off the threshold of 50, pointing to the downside. The %K line of the stochastic oscillator completed a bearish crossover with the %D line in the overbought zone, indicating a strong downside pressure in price.

Should the market extend its bearish mode and slip below the 50.0% Fibonacci, support could be met between the lower Bollinger Band near 1.3090 and the 1.3040 barrier, taken from the low on June 28. Then, if the market attempts to break this zone, the next stop could come at the 61.8% Fibonacci around the 1.2900 psychological level.

In case of an upward movement, GBPUSD would likely meet resistance at the upper Bollinger band, currently at 1.3350. A break above the Bollinger band would ease further declines, while a climb above the 38.2% Fibonacci near 1.3475 would help turn the short-term bias to a bullish one.

In the medium term, the bearish outlook remains intact, with the moving averages all pointing down. Looking at the weekly timeframe, the 20-SMA is ready for a bearish crossover with the 40-SMA.