Key Highlights

- The Euro traded higher recently and moved above the 1.1680 resistance against the US Dollar.

- There is a major bullish trend line formed with support at 1.1715 on the 4-hours chart of EUR/USD.

- The US NFP figure in June 2018 posted 213K, more than the forecast of 195K.

- Today in the US, the Consumer Credit Change in May 2018 will be released, which is forecasted to post $11.50B, more than the last $9.26B.

EURUSD Technical Analysis

The Euro gained traction this past week and moved above the 1.1680 and 1.1700 resistance levels against the US Dollar. The EUR/USD pair is currently placed in a bullish zone and it could trade further above 1.1750.

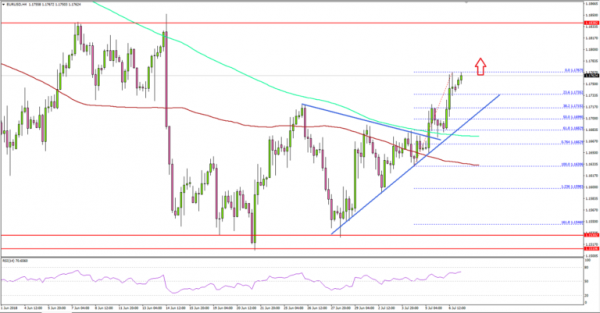

Looking at the 4-hours chart, the pair started a fresh upside wave from the 1.1630 swing low. It broke the 1.1650 and 1.1680 resistance levels. There was also a break above a major bearish trend line with resistance at 1.1665.

The pair closed above the 1.1680 resistance, 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours). The pair traded as high as 1.1767 and is currently consolidating gains.

An initial support is near the 1.1720 level and the 38.2% Fib retracement level of the last wave from the 1.1630 low to 1.1767 high. There is also a major bullish trend line formed with support at 1.1715 on the 4-hours chart of EUR/USD.

Therefore, as long as the pair is above the 1.1715-1.1720 support area, there are chances of more upsides in the near term. On the upside, resistances are at 1.1780 and 1.1800.

Recently in the US, the Nonfarm Payrolls report for June 2018 was released by the US Department of Labor. The market was looking for an increase of 195K jobs, compared with the last 223K.

The result was well above the forecast, as the US NFP figure in June 2018 posted 213K. The last reading was also revised up from 223K to 244K. On the flip side, the unemployment rate increased sharply from 3.8% to 4.0%.

The report added that:

The unemployment rate rose by 0.2 percentage point to 4.0 percent in June, and the number of unemployed persons increased by 499,000 to 6.6 million. A year earlier, the jobless rate was 4.3 percent, and the number of unemployed persons was 7.0 million.

The rise in the unemployment rate increased bearish pressure on the US Dollar. EUR/USD and GBP/USD gained traction and moved higher after the result, but gains were limited.

Economic Releases to Watch Today

- Germany’s Trade Balance for May 2018 – Forecast €20.0B, versus €19.4B previous.

- Germany’s Imports of goods and services May 2018 – Forecast +0.6%, versus +2.2% previous.

- Germany’s Exports of goods and services May 2018 – Forecast +0.4%, versus -0.3% previous.

- US Consumer Credit Change May 2018 – Forecast $11.50B, versus $9.26B previous.