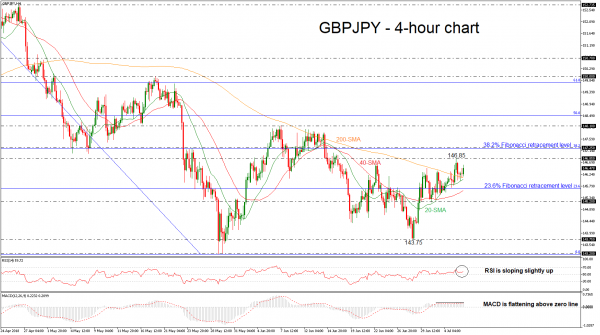

GBPJPY is still developing above the moving averages in the 4-hour chart but with weak movement over the last couple of sessions. Also, the price touched a new two-week high of 146.85 on Thursday but reversed some of its gains.

Looking at the short-term timeframe, the Relative Strength Index (RSI) hovers above the threshold of 50 and is sloping slightly to the upside. However, the MACD oscillator is flattening above the zero line and seems too weak for any strong upside movement in price action.

Upside moves are likely to find resistance at 146.85. Rising above this area would help shift the focus to the upside towards the 38.2% Fibonacci retracement level of the downleg from 153.80 to 143.20, which overlaps with the 147.25 resistance level.

On the flip side, in case of a drop below the 200- and then the 20-simple moving average (SMA), it would increase downside pressures towards the 23.6% Fibonacci of 145.70. Breaking this level could see a re-test of the 145.20 support, taken from the low on July 2.

In the longer timeframe, GBPJPY is set to complete the fourth bullish day in a row but remains in a downtrend, below 146.85.