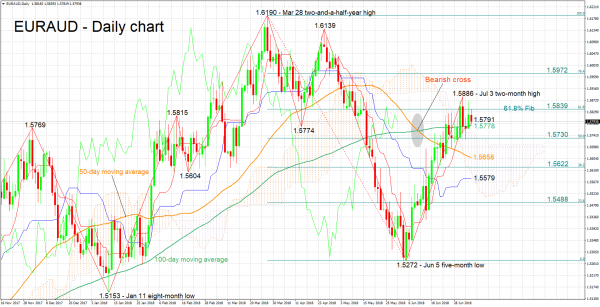

EURAUD has posted considerable gains after hitting a five-month low of 1.5272 on June 5. On Tuesday, the pair touched a two-month high of 1.5886.

The Tenkan-sen is above the Kijun-sen, pointing to a positive short-term bias. However, the fact that the Kijun-sen has flatlined is an indication of easing positive momentum in the near-term.

Further upside movement could meet resistance around the 61.8% Fibonacci retracement level of the March 28 to June 5 downleg at 1.5839. Stronger gains would turn the attention to the area around the two-month high of 1.5886 from earlier in the week which also encapsulates the 1.59 round figure.

On the downside, support may come around the current level of the 100-day moving average at 1.5778. The zone around this point includes the Tenkan-sen (1.5791), as well as the Ichimoku cloud top (1.5752). Further below, the 50% Fibonacci mark at 1.5730 would be eyed next.

Regarding the medium-term picture, the price action has defied the negative signal given by the bearish cross recorded in early to mid-June when the 50-day MA moved below the 100-day one. Specifically, since Thursday (yesterday), trading activity has been taking place above both the 50- and 100-day MA lines, as well as above the Ichimoku cloud, supporting the existence of a bullish tilt in the medium-term. Things are still “fragile” though, with a fall below the 100-day MA and back into the cloud setting the scene for a neutral outlook.

Overall, the short-term bias remains bullish though it seems to have lost part of its steam, while the medium-term outlook is positive, albeit only marginally so.