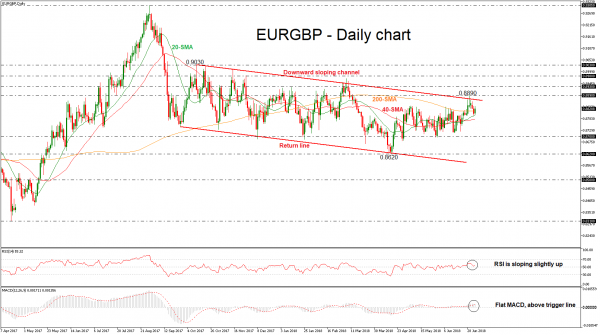

EURGBP came under strong selling pressure in the prior couple of days, following the pullback on the three-month high of 0.8890 and the descending trend line. Currently, the pair is trading above the short-term moving averages and is trying to have a closing day above the 200-SMA.

From the technical point of view, in the daily timeframe, the RSI indicator is pointing up and in positive territory above the 50 level. Also, the MACD oscillator is moving near the trigger line in the bullish area with weak momentum.

Strong gains could drive the price towards the next immediate resistance level of 0.8890, which stands near the falling trend line. In case of further upside pressure, the pair could penetrate the channel to the upside and drive EURGBP towards the 0.8930 barrier.

On the flip side, an immediate support level is likely to come from the 20- and 40-SMAs at 0.8796 and 0.8780, respectively. A break below that could lead prices near the 0.8700 handle, which has proved a strong resistance area in the past. Further losses could push the pair until the 0.8620 support.

In the longer timeframe, the pair remains in a slightly downward-tilting channel, which has been in place since September 2017 and failed to penetrate it at the end of June.