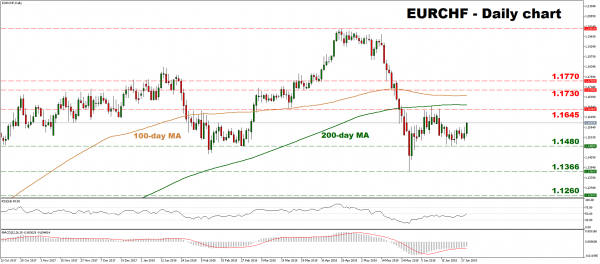

EURCHF touched a three-and-half year high of 1.2003 on April 20, before falling violently to post a ten-month low of 1.1366 on May 29. The pair recovered somewhat in the subsequent weeks and ever since May 31, it has been trading within a relatively tight sideways range, between 1.1480 and 1.1645.

Looking at momentum oscillators, the RSI – although marginally below its neutral 50 line – has rebounded and is pointing upwards, indicating that negative momentum is fading. Similarly, the MACD stands in negative territory, but rests above its red trigger line and is slowly edging upwards.

Combined, these suggest that the latest rebound may continue in the near-term, perhaps to challenge the upper bound of the aforementioned range, at 1.1645. That said, the area around 1.1645 capped several advances in June, and a clear closing candle above that level and the pair’s 200-day moving average – which rests not far above at 1.1663 – is needed for the near-term outlook to turn positive. In case of such an upside break, further advances could stall near the 1.1730 area, defined by the lows of May 18, before attention shifts to the May 17 trough of 1.1770.

On the downside, preliminary support to declines could come around the 1.1480 zone, identified by the June 21 lows, before focus turns to the pair’s multi-month low of 1.1366. A downside break would mark a lower low on the daily chart, turning the short-term outlook back to negative, and potentially opening the way for declines towards the 1.1260 zone, marked by the bottom of 18 August, 2017.

Overall, while both the short and medium-term pictures appear neutral at the moment, a continuation of the current rebound cannot be ruled out in the short run.