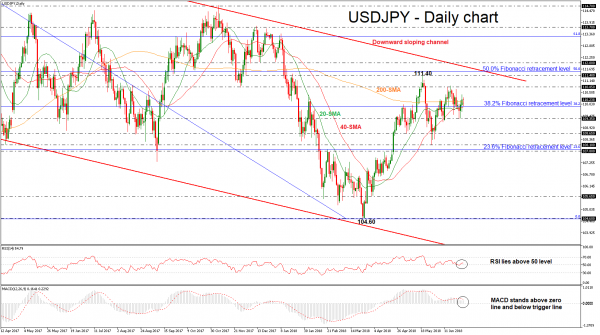

USDJPY remains in a narrow range during June with upper boundary the 110.85 resistance level and lower boundary the 109.35 support. Moreover, the 38.2% Fibonacci retracement level of the downleg from 118.60 to 104.60, around 109.95 acts as strong mid-level of the range, as the price is moving around this barrier.

The price is set to complete the third bullish day in a row after the bullish crossover of the 20- and 40-simple moving averages (SMAs) and the surpass of the 200-SMA in the daily timeframe. Technically, the RSI indicator is sloping upwards above the threshold of 50, while the MACD oscillator lies near its trigger line and is rising with weak momentum above the zero line.

Should the market edge higher and run above the 110.85 level, resistance could be met between the 111.40 resistance level and the 50.0% Fibonacci mark near 111.60. A leg above this area could send prices towards the 112.00 psychological barrier, which currently is in the path of the descending trend line of the longer-term falling sloping channel. In case of an upside violation of this level, it could shift the bearish bias to bullish.

On the flip side, if the pair bounces down and closes below the 38.2% Fibonacci, support could be met at the 109.35 hurdle. Further losses could drive the pair until the 108.65 obstacle taken from the low on May 4.

In the longer timeframe, USDJPY has been trading within a descending sloping channel since December 2016, while in the medium-term the market holds in an ascending movement after the rebound on the 104.60 support.