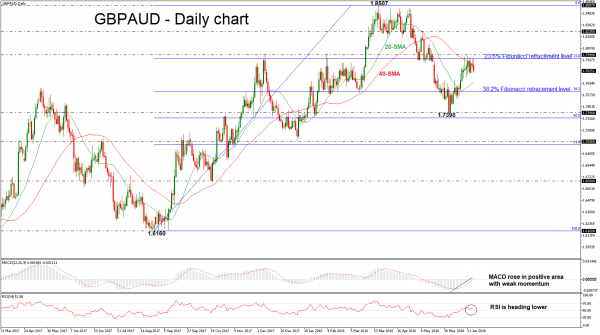

GBPAUD has touched several times the 23.6% Fibonacci retracement level of the upleg from 1.6160 to 1.8507, around 1.7953 over the previous six days. However, the 40-day simple moving average (SMA) also acted as resistance, hence the upside momentum appears to have run out of steam as prices have been attempting and failing to close above the line in the past sessions.

The neutral to bearish bias in the near term is also supported by the RSI, which has been hovering slightly above the 50 level but is still failing to cross into negative territory. The MACD oscillator stands above the zero line with weak momentum.

Should the pair manage to strengthen its positive momentum, the next resistance could come around the 23.6% Fibonacci of 1.7653. A break above this area would shift the bias to a more bullish one and open the way towards the 1.8235 high, taken from the peak on May 8.

However, if prices are unable to break the aforementioned obstacles to the upside the risk would shift back to the downside until the 20-day SMA near 1.7700 at the time of writing, with the level once again coming into focus. A drop below the moving average would signal a bearish movement. The next key support to watch lower down is the 38.2% Fibonacci of 1.7612.

In the medium term, the bullish outlook remains intact, with the 20-day SMA pointing upwards. However, should prices decline towards the mentioned SMA, this would risk shifting the medium-term picture to a more neutral one.