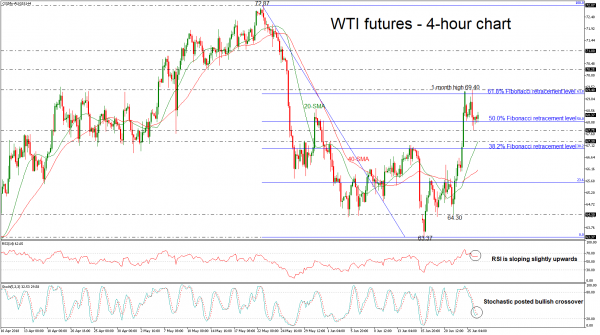

West Texas Intermediate (WTI) futures posted a negative day after they reached a new one-month high of 69.40 yesterday, while on Friday the price created sharp bullish extensions. The price eased and tested the 67.75 support level on Monday before the jump above the 50.0% Fibonacci retracement level of the downleg from 72.87 to 63.37, near 68.12, once again.

In the 4-hour chart, the RSI stands in the bullish area and is sloping slightly north, while the %K line of the stochastic oscillator posted a positive crossover with the %D line near the oversold zone, suggesting that the market would continue the upside momentum.

If the market manages to pick up speed, the 61.8% Fibonacci mark of 69.24 could offer nearby resistance. Then a leg above that level, the oil could meet the one-month high of 69.40, which stands marginally above the aforementioned barrier.

Should prices decline and drop below the 50.0% Fibonacci support could be found around 67.75, an area which provided strong resistance on Monday. Then a leg below that level, the oil could meet 67.30, which overlaps with the 20-SMA in the 4-hour chart, before the focus shifts to the 38.2% Fibonacci near the 67.00 handle.

In the medium-term, the outlook remains bullish since prices hold above all the moving average lines and the bullish cross between the 20- and the 40-SMAs stays in place.