Key Highlights

- The Euro declined and retested the last swing low of 1.1505-10 against the US Dollar.

- There is a connecting bearish trend line in place with resistance at 1.1700 on the 4-hours chart of EUR/USD.

- The US Services Purchasing Managers Index (PMI) (Prelim) in June 2018 declined from 56.8 to 56.5.

- Today in the US, the New Home Sales Change for May 2018 will be released, which is forecasted to increase 3.3% (MoM).

EURUSD Technical Analysis

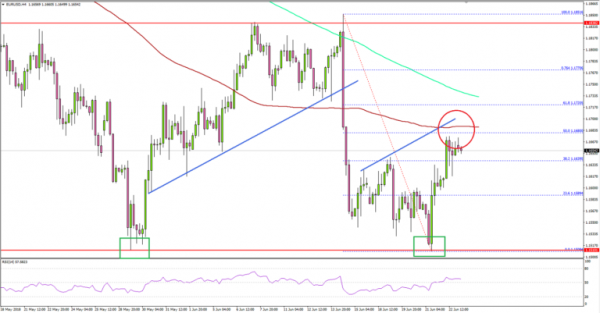

The Euro found support near the 1.1510 level after a major decline against the US Dollar. The EUR/USD pair is likely forming a double bottom pattern at 1.1510 and is poised for more gains.

Looking at the 4-hours chart, the pair once again found a strong buying interest above the 1.1500 level. A low was formed at 1.1508 and the pair jumped above the 1.1580 resistance.

There was a break above the 23.6% Fib retracement level of the last decline from the 1.1851 high to 1.1508 low. There was a decent upside move until the Euro found resistance near the 1.1680 level and the 100 simple moving average (red, 4-hours).

Moreover, the 50% Fib retracement level of the last decline from the 1.1851 high to 1.1508 low also acted as a resistance. There is also a connecting bearish trend line in place with resistance at 1.1700 on the same chart of EUR/USD.

Therefore, a break above the 1.1700 resistance may perhaps confirm the double bottom at 1.1510. In the mentioned scenario, the pair could accelerate gains towards the 1.1800 level.

Recently in the US, the Services Purchasing Managers Index (PMI) (Prelim) for June 2018 was released by Markit Economics. The market was looking for a minor decline in the PMI from the last reading of 56.8 to 56.4.

However, the actual decline was a bit less as the preliminary PMI reading came in at 56.5, which was still way above the 50 level. More importantly, the Flash U.S. Manufacturing PMI declined to 7-month low to 54.6, and the Flash U.S. Manufacturing Output Index fell to 9-month low at 54.0.

Overall, it seems like the US Dollar may correct lower in the near term, and major pairs like EUR/USD and GBP/USD could recover further.

Economic Releases to Watch Today

- German IFO Business Climate Index for June 2018 – Forecast 101.7, versus 102.2 previous.

- US New Home Sales for May 2018 (MoM) – Forecast +3.3% versus -1.5% previous.

- Dallas Fed Manufacturing Business Index for June 2018 – Forecast 18.2, versus 26.8 previous.