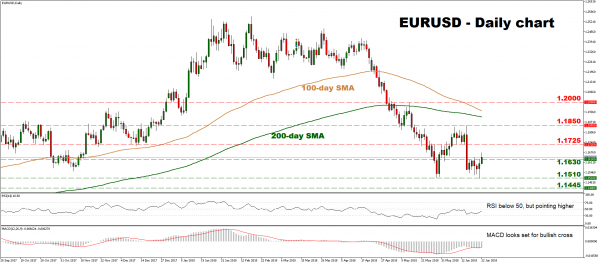

EURUSD reached an eleven-month low of 1.1510 on May 29, subsequently rebounded, but came back down to test that area again on June 21. However, the bears were unable to pierce that level, and now, a double-bottom formation looks to be in the works. A break above 1.1850 is needed to confirm such a pattern, in which case the odds for further recovery in the pair would increase substantially from a technical standpoint.

Momentum oscillators in the daily timeframe support the case for further recovery in the near-term. The RSI – although below its neutral 50 line – is currently pointing higher, while the MACD looks set to post a bullish cross above its trigger line. Both suggest that negative momentum is fading.

Advances in prices could encounter immediate resistance near 1.1725, a level defined by the inside swing low on June 8. An upside break would bring the June 14 high of 1.1850 into focus. Further advances from there would confirm a double bottom pattern, potentially opening the way for the psychological territory of 1.2000.

On the downside, further declines could find preliminary support near 1.1630, a level that halted several advances between June 15 and 21. A break below it could see scope for another test of the eleven-month low of 1.1510, with even steeper declines aiming for 1.1445, a level seen back in June 29, 2017.

Overall, the broader outlook for EURUSD remains bearish, but in the near-term, the latest rebound could continue. Should prices power above 1.1850, however, that could confirm a double bottom and signal a potential trend reversal.